To stay ahead of evolving consumer shopping trends and provide greater value to our beverage brand partners, we commissioned the Hi-Cone Pulse Survey starting in the Fall of 2023. Conducted by Doug Paxson, Hi-Cone’s Global Business Intelligence Subject Matter Expert (SME), this research study assessed consumer sentiment regarding the economy and how it is expected to shape purchasing behaviors in the year ahead.

A CAUTIOUS ECONOMIC OUTLOOK

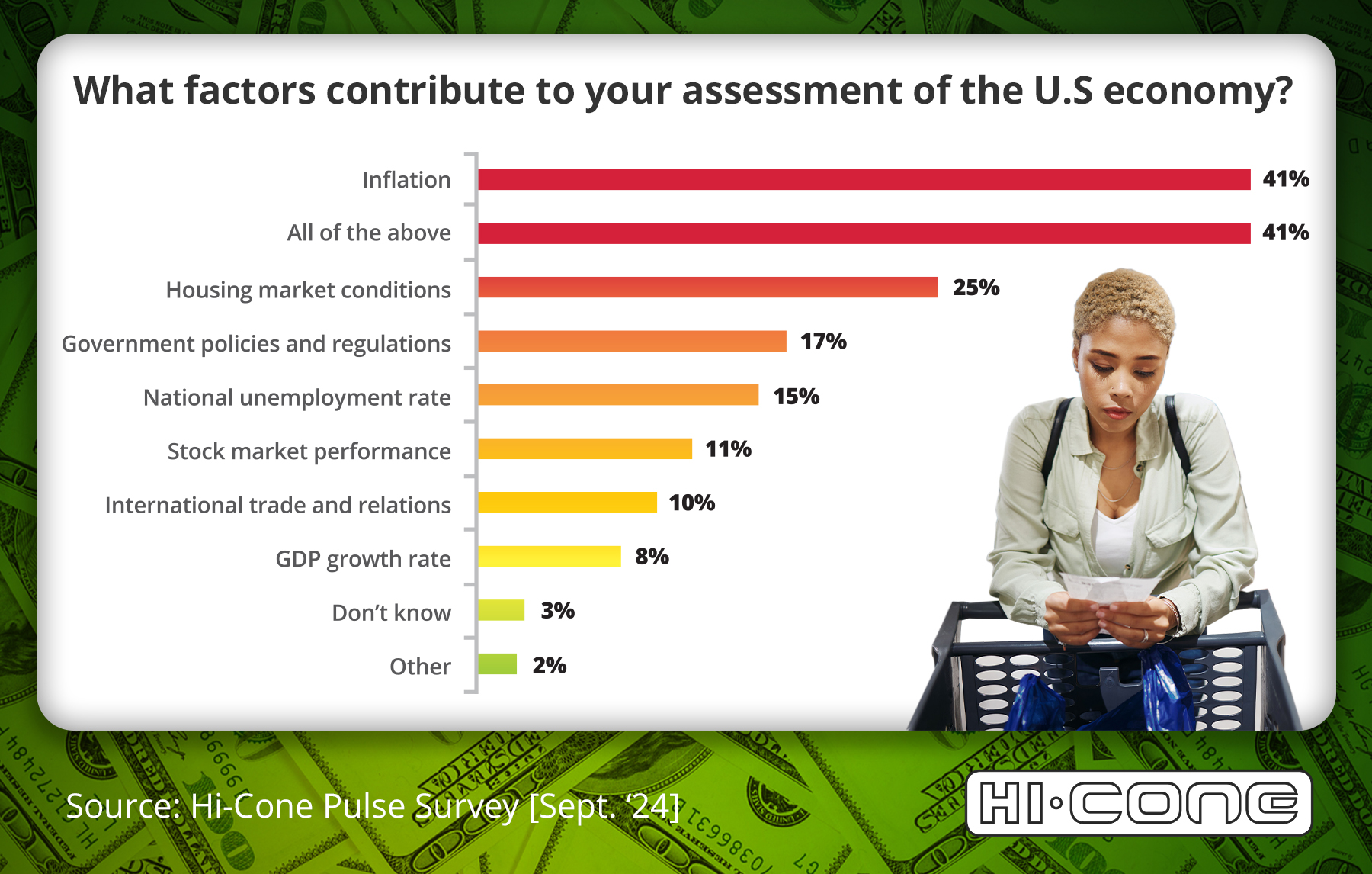

As of September 2024, consumer confidence remained low. Only 18% of survey respondents described the U.S. economy as “good” or “excellent,” while 50% rated it as “poor” or “very poor.” This reflects a broader sentiment of economic uncertainty that continues to influence purchasing decisions.

The survey identified key factors behind this perception. While positive indicators such as low levels of unemployment, a strong stock market, international trade, and GDP growth contributed to the 18% with a favorable economic outlook, inflation remained the dominant concern.

INFLATION’S LINGERING IMPACT ON CONSUMER BEHAVIOR

Among those who rated the economy negatively, inflation was the primary factor influencing their outlook. Although inflation has moderated, persistent price increases—particularly in groceries—continue to shape consumer sentiment. In September 2024, 51% of respondents identified groceries as experiencing the steepest price hikes, a number that rose to 61% among those with the most negative economic views.

As a result, shoppers are prioritizing value, reassessing their expenses, and making more deliberate purchasing decisions. This presents a significant opportunity for beverage brands to drive unit volume in 2025 by differentiating themselves at the point of sale.

WHAT THIS MEANS FOR BEVERAGE BRANDS

With consumers carefully managing their budgets, beverage brands must reinforce their value proposition to remain in shopping carts. Categories such as carbonated soft drinks, sports drinks, and beer face increasing pressure to justify their place in consumers’ purchases.

Shortly, consumer spending habits will continue to be shaped by economic concerns. Beverage brands that proactively address these trends—by enhancing their in-store presence and reinforcing their relevance—will be best positioned for sustained success in a competitive marketplace.

COMMONALITIES ACROSS BEVERAGE CATEGORIES

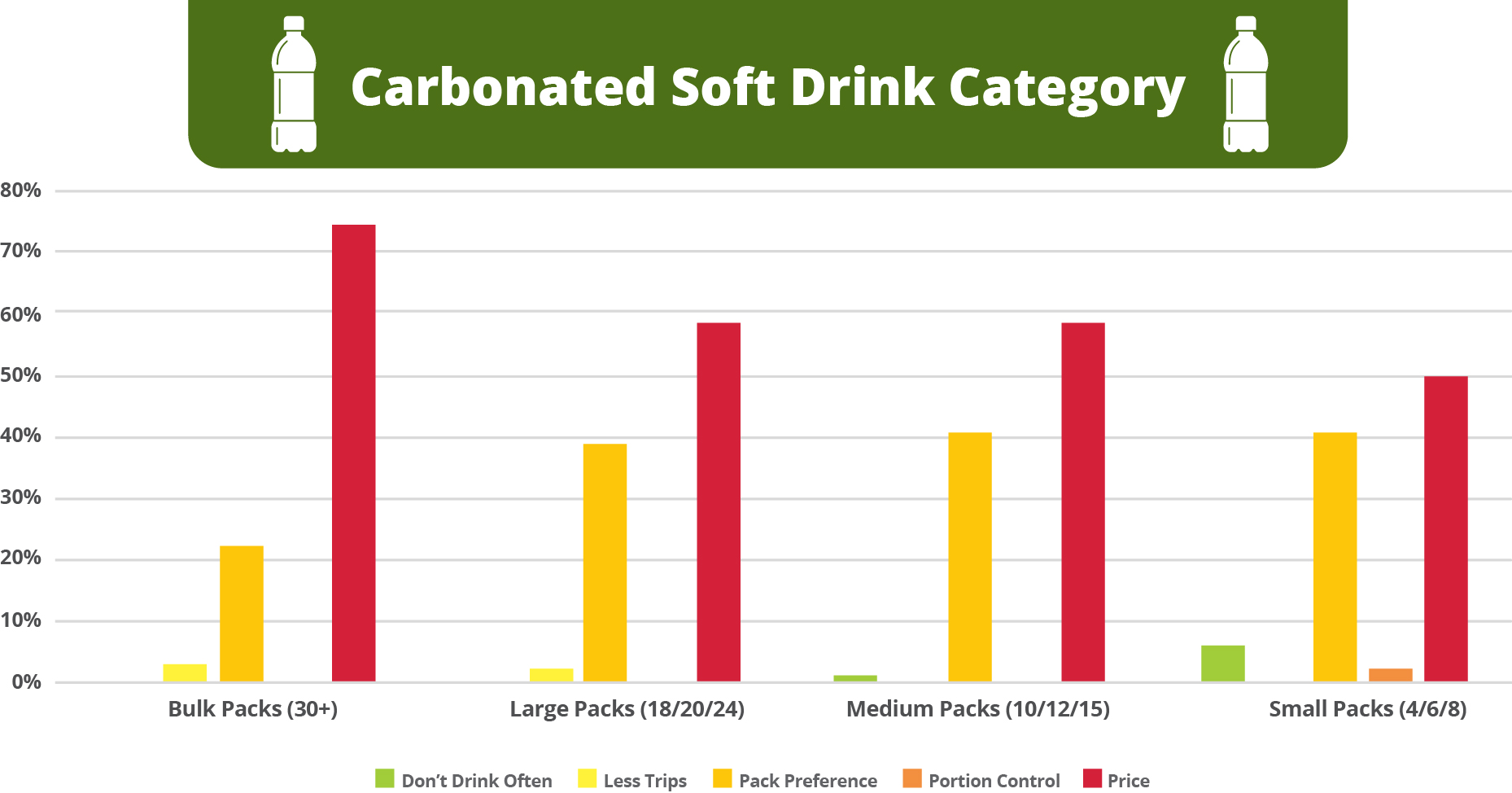

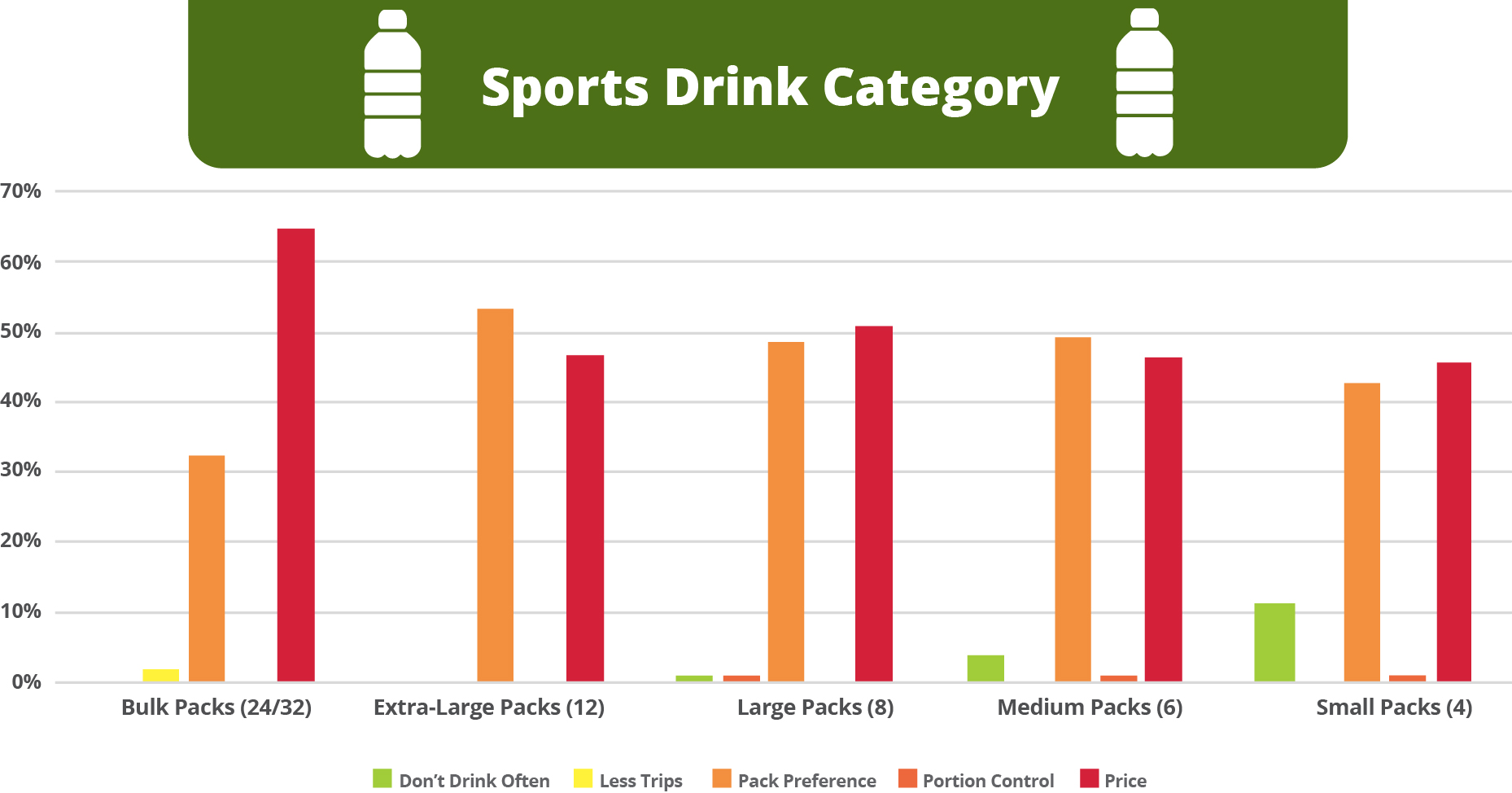

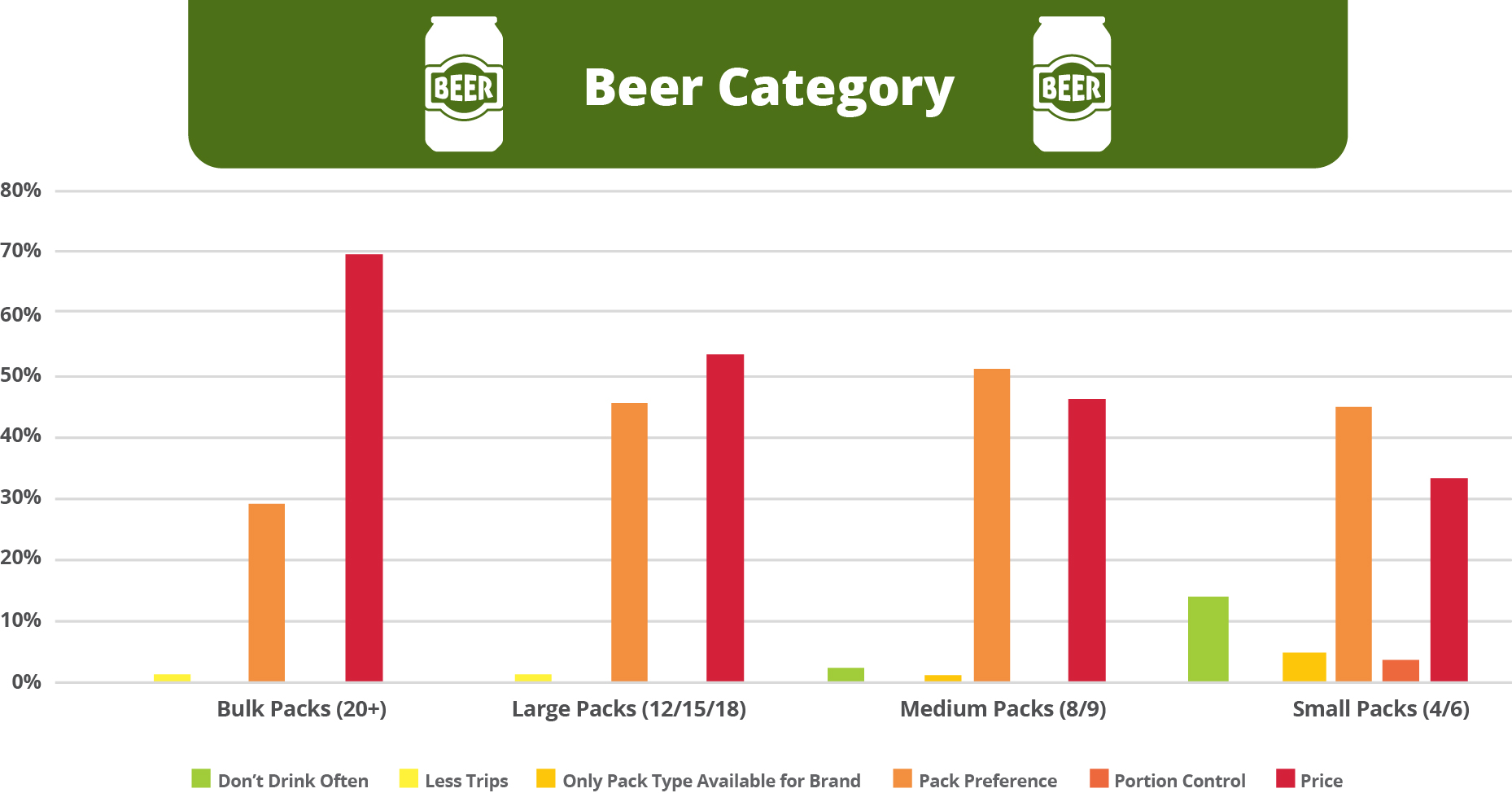

The Hi-Cone Pulse Survey included a series of questions about consumer decision drivers relating to package size, which ranged from bulk packs (24/32 packs) down to small packs (4/6/8 packs). Across all size packs, respondents indicated that economic influences play a part in package selection. Some respondents look for the best value to stretch buying power while others seek the lowest price on the shelf to fit into budgets. Shoppers select sizes due to the amount of product offered in the pack deemed as “just right” for their needs. These “right-sizing” drivers included a variety of factors, including size of family/household, frequency of consumption, and affordability.

CARBONATED SOFT DRINK SEGMENT

While buyers in this beverage segment look for value to stretch their buying power, retail formats offering medium packages (10/12/15) (where large and bulk packs are not offered) can drive multi-package purchases through promotions. The price point at the shelf is less than bulk and large packs, for shoppers who still want value but do not have sufficient funds in their budget to pay for large bulk packs.

In this beverage category, small packs (4/6/8) have the lowest shelf price, making them the most affordable despite not offering the same value as the larger packs. Consumers with tight budgets are trading down into this size, sometimes weighing buying a small pack or not purchasing at all that trip. These packs appeal to small households or households where only certain members consume. Also, the size appeals to those who do not drink very often. Shoppers who like variety will buy these packs to mix and match flavors.

Verbatims from consumers support these trends:

“The price at the time [drove the decision to purchase] even though the unit cost is higher.”

“Enough product and fits into my weekly paycheck budget.”

“Due to the high price of soda, we buy small amounts of soda each week and try to drink more water instead of soda because it is too expensive.”

“It’s easy to carry and doesn’t take a lot of space in my pantry.”

“The brands and flavors we like are on sale in those sizes.”

SPORTS DRINK CATEGORY

Shoppers in the sports drink category are driven by quantity needs as well as value when determining the pack size to purchase. Those purchasing for a specific event/need will use quantity as the guide for size whereas those looking to maximize value purchase large sizes for volume discounts and smaller sizes for price points.

Small and medium packs strike a balance of quantity and shelf price for those buyers looking to keep within their budgets. These shoppers are trading down into small/medium packs from larger packs due to inflationary price increases. Some shoppers purchase these sizes to mix flavor choices or seek out certain size bottles which may not be an option in larger quantity packs. Those who are looking for portion control purchase in this tier to avoid the temptation of over-consuming at home. Others only need a small amount, eliminating the need for larger-sized packs.

Buyers supported these considerations with these words:

“It is a balance of quantity and price to meet my needs and financial capabilities.”

“Cost! I prefer to buy small and when we can buy in bulk, we do”

“We have to stay hydrated, but the cost is too high to buy larger package sizes.”

“I can only get what I need to have on hand for emergencies – food is too expensive”

“Because I want to cut down on package size, so it can help reduce calorie size in my body.”

“I enjoy having a lot of different flavors, so if I get the smaller quantity, I can have more flavor choices.”

BEER CATEGORY

The purchasing decisions of small and medium beer pack buyers are influenced by a range of factors, particularly in the face of inflation and shifting consumer priorities. Some shoppers are downsizing pack sizes as a direct response to rising prices, adjusting their grocery budgets to accommodate essential purchases. Others view beer as a luxury category and opt for smaller packs to allocate more of their budget toward necessities.

While many consumers recognize the better value of larger packs, the higher upfront cost often makes them unattainable within their financial constraints. For these shoppers, a lower shelf price takes precedence over overall value. Additionally, some buyers prefer smaller packs due to moderate consumption habits or a conscious effort to limit intake. Others, including craft beer enthusiasts, gravitate toward 4- and 6-packs, to mix and match flavors, adding variety to their purchase.

Buyers in the beer category spoke to their decision drivers in statements like these:

“The prices have increased and so I’m trying to control alcohol spending.”

“Normally it’s hard to have a larger amount of money saved to buy the bigger packs of beer.”

“I like to buy smaller sizes because I like to try new kinds of beer.”

“Small is cheaper and sometimes you get a good discount on that too.”

“I want to reduce my alcohol consumption because of health reasons.”

TURNING POINT-OF-SALE CHALLENGES INTO OPPORTUNITIES WITH PACKAGING

With economic conditions persisting, fierce competition for shoppers’ “share of wallet” is forecast to persist. However, regardless of the beverage category, packaging can create a clear brand advantage with buyers on the store shelf. This is especially evident in small (4/6 units) and medium (8/12 units) pack sizes, where the ability of a carrier to deliver relevant and differentiating messaging at the moment of selection can tip the scales in a brand’s favor.

The ability to deliver brand positioning on the shelf is vital. Beverage brands can reinforce their consumer appeal and find a place in the basket through the on-pack messaging afforded by a multi-promotional carrier (MPC) solution. The MPC carrier utilizes a larger handle to create a billboard for messaging that stays with the pack, from the creation of the pack to the shelf through the point of consumption. Ensuring that relevant messaging gets to the shelf during the moment of selection can make the difference in which packs a shopper purchases.

The additional benefits of MPCs include:

- BUDGETARY: Cost savings realized through less complexity and improved execution when running in-store marketing programs.

- MARKETING: Pack identification, promotional AND product information, pricing/coupons, as well as QR and bar codes can be printed on MPC labeling.

- PRODUCT: On-pack label with reverse printing available and up to six colors without increased cost.

- LONG-TERM: The message stays with the intended pack beyond the point of purchase to maximize impact.

IN SUMMARY

Throughout 2025 and beyond, consumer spending habits will continue to be shaped by economic concerns. Beverage brands that proactively address the trends—by effectively communicating their value to shoppers at the point of purchase—will be best positioned to find a place in the buyer’s basket and achieve sustained success in a competitive marketplace.

> For more information on multi-promotional carrier (MPC) solutions click here.

> To contact a Hi-Cone MPC solutions specialist click here.

About the Author

Doug Paxson currently serves as the Global Business Intelligence expert at Hi-Cone, a leading supplier of ring carrier multi-packaging systems. In this role, he is responsible for understanding macro and microeconomic factors to drive insights that support customers’ growth in the beverage industry.